Salary and Wages Calculator

Table of Contents

In today’s fast-paced business environment, maintaining accurate financial records is essential—not just for compliance but also for making informed decisions. Among the many calculations that organizations need to perform regularly, salary and wages audits are critical. Whether you’re an HR professional, an accountant, a government auditor, or a business owner, having access to the right tools can save you hours of work. One such essential tool is the Salary and Wages Calculator, also referred to as the Minimum Wage Audit Calculator.

This blog post will take you through everything you need to know about this calculator—what it does, how it works, its real-world use cases, and why it’s an indispensable part of any audit toolkit.

What is a Salary and Wages Calculator?

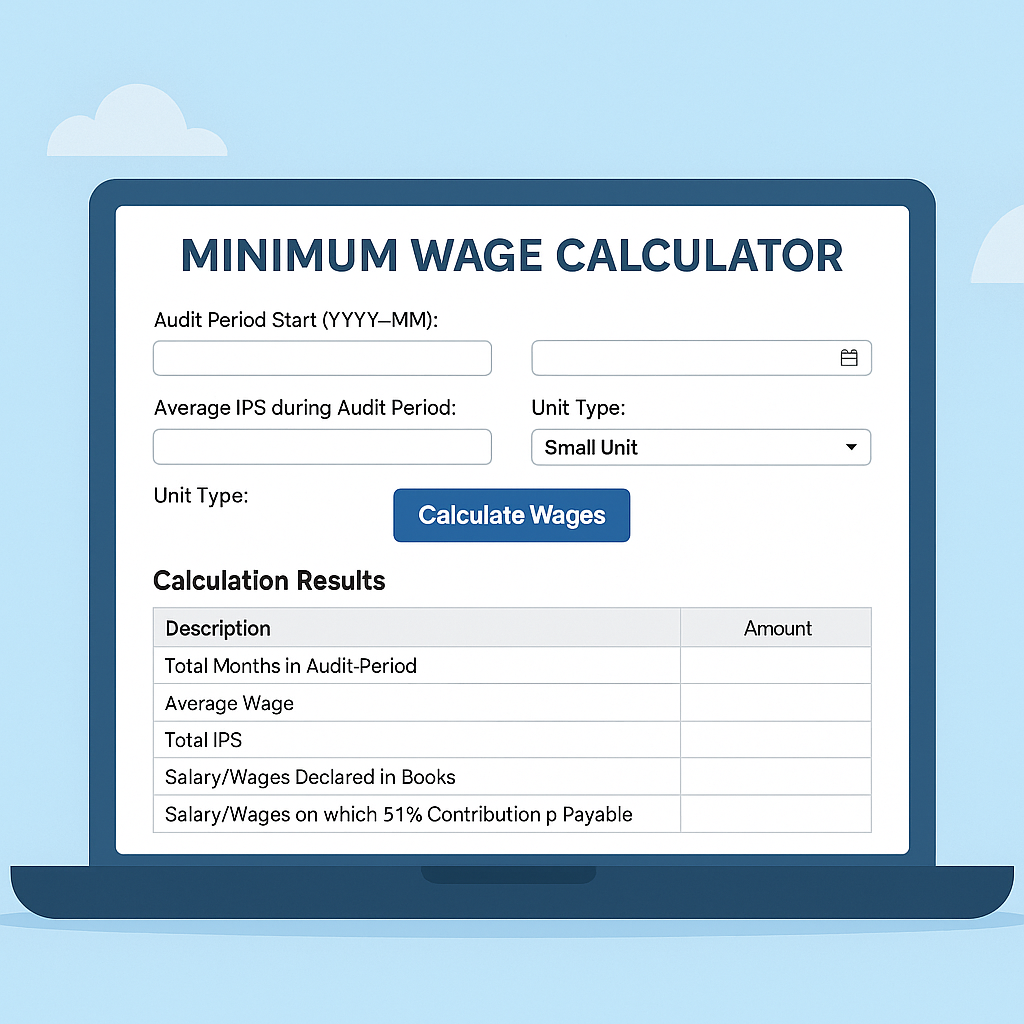

A Salary and Wages Calculator is a simple yet powerful tool designed to help users estimate the total salary or wage expenses based on several audit-related parameters. These typically include:

- Audit Period (Start and End Dates)

- Average Insured Persons (IPS) during Audit

- IPS Deducted During Audit

- Unit Type (Small or Big Business Unit)

This tool is specifically useful in situations where historical wage rates vary over time (as in Pakistan’s EOBI system, for example), and the organization needs to determine compliance with minimum wage laws over a span of several months or years.

Key Inputs Explained

Let’s walk through the inputs this calculator requires:

1. Audit Period (Start and End)

The period under audit. This can span months or even years. Based on this, the calculator determines the number of months in the period.

2. Average IPS During Audit

This refers to the average number of insured persons (employees) reported during the audit period.

3. IPS Deducted During Audit

This is the actual number of employees for whom deductions were made for contributions (e.g., EOBI in Pakistan).

4. Unit Type

The unit type (Small or Big) determines a unit factor (1.15 for Small units, 1.30 for Big units) which influences the final wage figures.

Core Features of the Calculator

✅ Automatic Period Calculation

The calculator automatically counts the number of months between the given start and end dates.

✅ Average Wage Calculation Based on Time-Based Rates

It intelligently calculates the average wage over the given period by referencing a predefined rate table (e.g., wage rates from 1976 to 2025, with multiple updates).

✅ Comprehensive Salary Projections

The calculator provides two key results:

- Salary/Wages Declared in Books

- Salary/Wages on Which Contributions Are Payable

These figures are essential for compliance audits and accurate payroll analysis.

IF YOU WANT VR07 EXACT AMOUNT USE THIS CALCUALTOR

FOR INSURED PERSON DETAILS

Why is This Calculator So Useful?

🔍 1. Precision in Financial Audits

The tool takes the guesswork out of wage audits by providing exact figures based on historical wage data.

⏱ 2. Time-Saving for HR and Finance Teams

Manual calculations across several years of data can be tedious. The calculator automates this process, saving significant time.

📊 3. Compliance and Risk Management

Failing to comply with wage regulations can lead to penalties. This tool helps businesses verify compliance and avoid potential legal issues.

🌐 4. Useful for Government and Corporate Auditors

Government agencies and private audit firms alike can use the calculator to ensure companies are reporting wages accurately.

How Does It Work? A Behind-the-Scenes Look

The calculator uses a table of wage rates that span several decades. For example:

javascriptCopyEditconst rates = [

{ from: '1976-07', to: '1985-06', minWage: 1000 },

{ from: '1985-07', to: '1993-09', minWage: 1500 },

{ from: '1993-10', to: '2001-06', minWage: 3000 },

// ... and so on

];

When a user enters a date range, the calculator breaks it down into individual months and finds the corresponding wage for each month. It then averages those values to determine the Average Wage during the period.

Next, using the formulas below, it calculates:

➤ Total IPS:

plaintextCopyEditAverage IPS + IPS Deducted During Audit

➤ Salary/Wages Declared in Books:

plaintextCopyEditTotal IPS × Average Wage × Number of Months × Unit Factor

➤ Salary/Wages on which Contributions are Payable:

plaintextCopyEditIPS Deducted × Average Wage × Number of Months

The end result is a fully auditable report with all the necessary wage figures.

Real-World Applications

🏢 Businesses

Ensure compliance with national minimum wage laws. Identify if you are underreporting or overreporting salary expenses.

🧾 Audit Firms

Quickly evaluate if your client meets the wage declaration standards.

🏛 Government Inspectors

Verify reported wages during official labor audits.

💼 Accountants

Help clients identify discrepancies in wage payments and contribution records.

Conclusion

The Salary and Wages Calculator is more than just a mathematical tool—it’s a compliance assistant, a time-saver, and a powerful asset for accurate payroll and audit reporting. With just a few inputs, it provides detailed salary analysis based on historical wage data and user-defined parameters.

Whether you’re auditing a large corporation or managing HR in a small firm, incorporating this calculator into your toolkit will drastically improve the accuracy and efficiency of your financial assessments.

What is a Salary and Wages Calculator?

The Salary and Wages Calculator is a tool designed to help calculate total wages, declared salaries, and contribution-based salaries during a specific audit period based on historical minimum wage rates, insured persons (IPS), and unit types (small or big).

How does the calculator determine the average wage?

The calculator uses a predefined table of monthly minimum wages from 1976 to 2025. Based on the audit period entered by the user, it selects the applicable wage for each month, sums them, and divides by the total number of months to determine the average wage.

What is the purpose of the “Unit Type” selection?

The “Unit Type” determines the unit factor:

Small Unit applies a factor of 1.15

Big Unit applies a factor of 1.30

This factor is used to adjust the total declared salary/wages in the final calculation.

What is the formula for Salary/Wages Declared in Books?

(Total IPS × Average Wage × Total Months × Unit Factor)

What does IPS stand for in the calculator?

IPS stands for Insured Persons, i.e., employees registered under contribution-based systems (e.g., EOBI). The calculator uses:

Average IPS during the audit period

IPS deducted during the audit

These values are combined to calculate total IPS

How is “Salary/Wages on Which 5+1% Contribution Payable” calculated?

This is based only on the IPS deducted during the audit and is calculated as

IPS Deducted × Average Wage × Total Months

Is this calculator suitable for EOBI or other contribution-based audits?

Yes! The calculator is especially useful for systems like EOBI (Employees’ Old-Age Benefits Institution) where wage audits are conducted, and contributions are based on historical wage rates.

Can I use this calculator for multiple years of audit periods?

Absolutely. You can select an audit period that spans multiple years. The calculator automatically uses the appropriate wage rate for each month across different years.

Are the wage rates in the calculator customizable?

Yes, the wage rate table can be updated as per the country or region’s official notifications. The current version includes rates from 1976 to 2025, but you can extend or update this table as needed.

Can this calculator be used on a WordPress site?

Yes! The calculator is designed to be fully compatible with WordPress. It can be integrated as a plugin or embedded via shortcode into any post or page.